One of the most crucial, and often overlooked, details that can prevent mineral and royalty sellers from losing thousands, is not understanding the importance of two very important terms used in the oil and gas industry: Net Mineral Acres and Net Royalty Acres.

When a mineral buyer submits an offer to you, they will base it on mineral acres or royalty acres. At first glance, you may think their offer is fantastic, but have you noticed whether it’s based on the net mineral acres or royalty acres? This can make a significant difference when determining the value of the offer and help you when negotiating with mineral buyers.

Sometimes, buyers will let you “do the math” and at the same time, try to rush you into accepting their offer with a warning that it will expire.

This is your first sign that you need to slow down, get some professional guidance, and take the time to sort out what the buyer is really offering you.

What Is A Net Mineral Acre?

A Net Mineral Acre (NMA) is the net mineral interest owned by a mineral owner from under the gross acres of a particular parcel or tract of land.

Once they’re leased, the net mineral acres can then be converted to Net Royalty Acres, or NRA.

What Is A Net Royalty Acre?

A Net Royalty Acre (NRA) is a net mineral acre that has been leased by an Operator and therefore subject to an oil and gas lease. It will have a royalty percentage granted to it such as ⅛ or 12.5% and upwards to 25%. This simply means that once the Operator drills and produces the acreage, and then sells the oil and/or gas production, the mineral owner will receive the percentage of the royalty granted in the lease proportional to the amount of interest they own in the production unit, while the Operator receives the remaining revenue.

Conversely, when a Net Royalty Acre lease expires and does not get leased again, it reverts back to being called a Net Mineral Acre.

Note: The amount of unleased Net Mineral Acres and leased Net Royalty Acres are equal provided that when the minerals are leased, they are leased at ⅛ royalty or 12.5%.

For example, if a mineral owner owns 100 unleashed Net Mineral Acres they also own 100 Net Royalty Acres if the minerals are leased at ⅛ royalty or 12.5%. They’re the same.

Only when a mineral interest is leased at more than ⅛ royalty will the Net Royalty Acres be greater than the Net Mineral Acres.

How To Calculate Net Mineral Acres

Calculating Net Mineral Acres can be done two ways, depending on the information you have available to you:

- Using your known amount of Net Royalty Acres (NRA)

- Using your known amount of Division of Interest (DOI)

You may use our own calculators here to help determine your NMA.

How To Calculate Net Royalty Acres

Calculating Net Mineral Acres can also be done two ways, depending on the information you have available to you:

- Using your known amount of Net Mineral Acres (NMA)

- Using your known amount of Division of Interest (DOI)

You may use our own calculators here to help determine your NRA.

What Is Division Of Interest?

Division of Interest, or DOI, is your percentage of ownership in a unit that an Operator has formed. This number is used to verify you are receiving the correct amount in royalties. It can vary from unit to unit and well to well.

How To Calculate Division Of Interest

Like the others, calculating Division of Interest can also be done two ways, depending on the information you have available to you:

- Using your known amount of Net Mineral Acres (NMA)

- Using your known amount of Net Royalty Acres (NRA)

You may use our own calculators here to help determine your DOI.

Two Examples Of How Not Knowing The Difference Between NMA And NRA Can Cost You

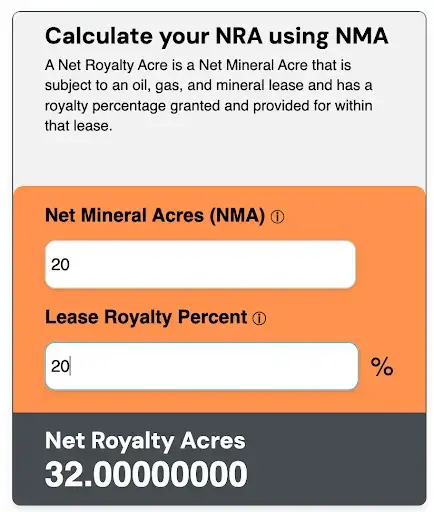

Janet inherited 20 Net Mineral Acres (NMA) and was granted a 20% royalty lease:

Using our mineral rights royalty calculator, we can calculate that Janet has 32 Net Royalty Acres:

Janet receives two offers for her 20 NMA/32 NRA. Company #1 makes an offer based on Net Mineral Acres and Company #2 makes an offer based on her Net Royalty Acres:

Company Offer #1 is $7500/NMA

Company Offer #2 is $5000/NRA

At first glance, Company Offer #1 of the $7500/NMA looks better, but it isn’t.

Let’s do the math:

$7500/NMA x 20 = $150,000

$5000/NRA x 32 = $160,000

That’s a $10,000 difference!

Not much you might think? What about this example…

Company Offer #1 is $7500/NMA

Company Offer #2 is $7500/NRA

Let’s do the math:

$7500/NMA x 20 = $150,000

$7500/NRA x 32 = $240,000

If you sold to Company #1 that offered you $7500 on a Net Mineral Acre basis, you would have lost out on $90,000!

Conclusion: Tips For Selling Your Minerals

So do you see how important it is to understand how buyers’ offers are being presented to you when selling your minerals?

Unfortunately, it’s quite common for mineral owners to not know exactly how much interest they own. Taking the time to review the information you have and sort out how much interest you own with the help of our mineral and royalty calculators will prove to be a worthwhile task, especially when buyers are contacting you to purchase your oil and gas interests.

If you are receiving offers, there are some things to look out for so schedule a consultation with us so we can help you determine if the offers are fair and we can give you a valuation of mineral rights. It never hurts to have a professional look at your situation and offer guidance. Our consultations can be scheduled at a time convenient for you. Book here now.

*Disclaimer when using our mineral and royalty calculators: If you find any contradictions in your calculations there could be other determining factors, including, but not limited to: previous conveyances, variations in unit sizes, size of gross acres relative to unit sizes, and if your interests are held by allocation wells. If your interests are subject to any of the aforementioned, this will require additional information and will be subject to variation in the calculations. Please schedule a time to speak with us for additional help.

Leave a Comment