Land for Sale with Mineral Rights

The United States is made up of approximately 2.3 billion acres, which 375 million of those acres make up Alaska and 1.9 billion make up the lower 48 states.

Of the 1.9 billion acres, as of 2015 the federal government owned approximately 700 million acres, or 30.5%, of the 2.3 billion acres. That leaves 1.6 billion acres, give or take, that are owned by individuals, families, trusts, corporations, etc.

This gives any investor a fighting chance at buying some very good minerals and royalties.

Investing in Oil and Gas Minerals & Royalties

The only real risk to investing in minerals and royalties is tied to commodity prices.

Once the assets are purchased, you own them (outside of Over-Riding Royalty Interests). You have no monthly operating expenditures in order to maintain your investment or equipment, only annual taxes and that’s only if the interests are producing.

As long as you diversify your holdings to incorporate both oil and natural gas assets located in different basins or areas of the U.S., you should have no concentration risk.

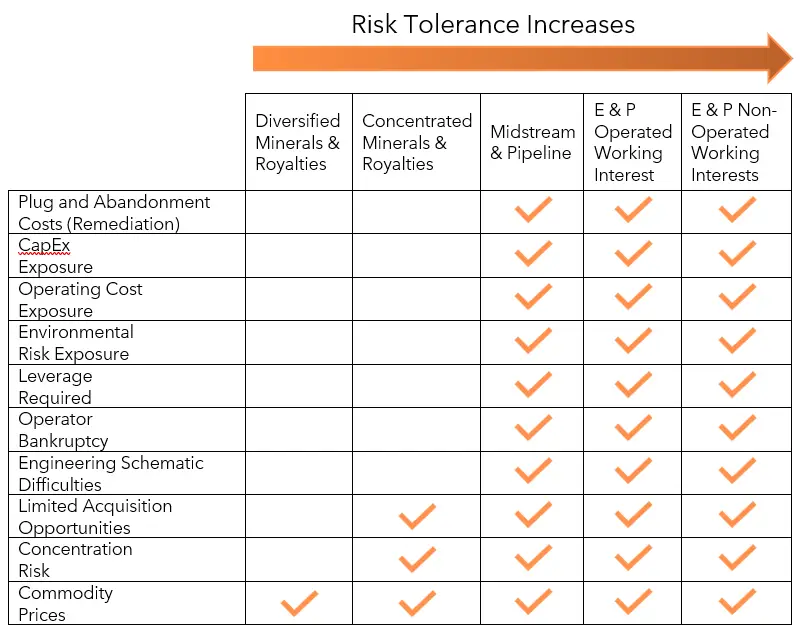

To provide a simplified overview of investment strategies in the upstream sector, we’ve created a table comparing various strategies and their associated level of risk.

How to Invest in Oil and Gas

If you are seriously considering investing in minerals and royalties, there are a few fundamental questions you will want to ask yourself before you decide to invest:

- Do I know what geographic location or basin I would like to buy in Permian, Eagle Ford, Austin Chalk, or Haynesvillle?

- Do I know how to find only legit opportunities in my desired focus area?

- Do I know how to determine what is a good buy when I start to find opportunities?

- Do I know the difference between Surface Rights, Mineral Rights, and Royalty Rights?

Even if you did not doubt your answers to any of these basic questions, it’s still vital to have a conversation with a seasoned industry professional.

Have you checked out our FAQ page yet? It’s full of definitions, scenarios, and easy to understand explanations of all things related to minerals and royalties.

Schedule a consultation with us today to help you get started or contact us through the form below and we will get in touch with you.

Leave a Comment