A lot of factors go into this answer, however, much of the value for minerals and royalties in the Austin Chalk depend on timing and when new wells are going to be drilled and what the price per barrel of oil and price per mcf of natural gas at present time and potentially what it will be in the next 3-5 years.

The wells in the chalk are deep and expensive to drill so it has to be economic for operators to ramp up drilling in this formation.

Minerals and royalties in the Austin Chalk can be worth a lot or they can be worth significantly less and the price per net royalty acre can very greatly from one area to another.

Recovery in the Austin Chalk

The values for Austin Chalk minerals and royalties dropped significantly during Covid.

The mineral buying space didn’t dry up completely in 2020, although the pause button was definitely hit due to lack of demand for oil and gas, but the pumps have sinced turned back on. I regularly pass through areas of the Austin Chalk/Eagle Ford and see pumpjacks operational again.

Unless there are some key activities happening where your minerals are located, you should have a positive outlook on your mineral values for interests located in the Austin Chalk.

Those activities could include old wells being re-worked by a new operator, a fresh permit filed with the TRRC, and a previously drilled but uncompleted well or wells (DUCs) now being completed.

In other more sought after areas or plays, I’m finding that mineral and royalty buyers have gotten extremely picky and only desirous of purchasing minerals and royalties in the core areas of the play.

They have moved entirely off the fringes of the play in almost every area and in some cases have abandoned an area all together.

The Austin Chalk has been exploited through conventional production methods for decades and has been largely overlooked for many years due to the drive to horizontal development of the shale plays.

However, prior to Covid it was a solid performer in oil and natural gas production and had some of the most sought after minerals and royalties due to the longevity of production from this oldie but goodie.

We are continuing to see activity grow in the following counties: Karnes, Gonzales, and DeWitt, to name a few.

Whether your minerals are valuable in these areas depends greatly on their stage of development.

Do you know what stage your interests are in?

Selling a portion of your interests could be a smart move if you need to respond for any life event and after an evaluation, we can determine what your chances are of receiving bids, what those bids might be, and who could be interested.

It’s never a bad time to see what your minerals are worth in the free market. Once you have the power in your hands, you can make intelligent and confident decisions about what to do next.

The History of the Austin Chalk

Since at least the 1920’s, the Austin Chalk has been producing oil and gas in Texas from vertical wells and has often been referred to as “Swiss Cheese”.

It was given this name due to the fact that in the early days of drilling, one operator would make a gangbuster well “on one side of the street”, and another operator playing the game of “close-ology” trying to capitalize on the previous operators success would drill a well “on the other side of the street” and come up dry, nothing.

This happened over and over, and it was well known in the early days of the Austin Chalk; it made many of oil men rich and made many of them broke, and some both a couple times over.

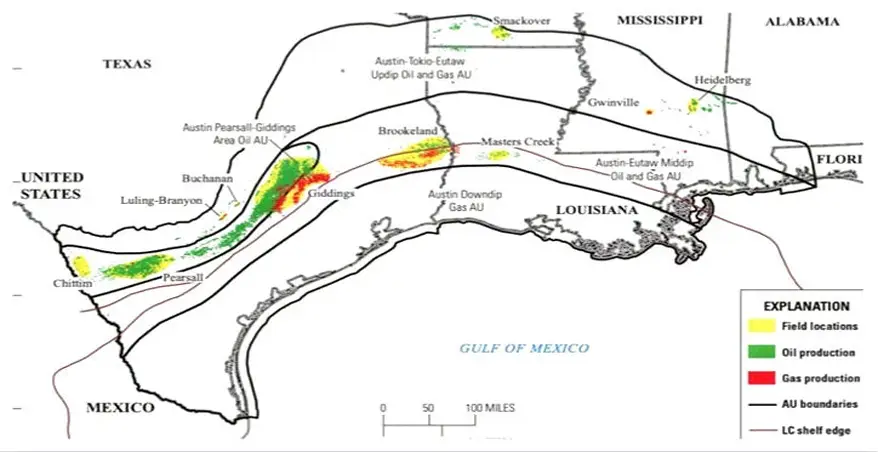

The largest Austin Chalk oil field is the Giddings Field, located in parts of 7 counties with cumulative production of 526 million barrels of oil and 4.7 trillion cubic feet of gas.

The Austin Chalk directly overlies the prolific Eagle Ford Formation which is the primary source of most of the oil in the chalk. Oil migrates into the chalk through micro-fractures and fills the tectonic fractures and the porous matrix, the “swiss cheese”.

Widespread use of fracture stimulation in vertical Austin Chalk wells began in earnest as a response to the 1973 Middle East Oil Embargo.

Oil production increased over the next six years from 7,300 (BOPD) barrels per day to 147 (MBOPD) thousand barrels per day in 1981. Gas production increased from 7 (MMCFPD) million cubic feet/day in 1974 to 475 (MMCFPD) million cubic feet per day in 1982.

Austin Chalk production declined as oil prices declined thru the 1980’s. The next shift in technology began in 1989 with the widespread use of horizontal drilling. The Austin Chalk, however, largely ignored the application of this technology until it was more technologically advanced and really kicked off in 2013.

Finally in 2015, the Austin Chalk oil and gas production began to slowly increase after years of slow decline and now has cumulative production of 948 million barrels and 5.6 trillion cubic feet of natural gas through the end of 2016.

Initially, producers targeted the natural fracture zones in the chalk, but high initial rates of production quickly declined due to the draining of the open fracture systems.

This vintage article described the Austin Chalk as “the most perverse, contrary, incorrigible oil field known to man“.

Venergy is here to answer your questions about the state of oil and gas in this prolific area. Fill out the form below if you need some help, or schedule a time speak with us.

By the way, have you visited our FAQ page? We have tons of questions and answers covering a wide range of mineral and royalty topics and scenarios.

Leave a Comment