I’m a BIG Big Lebowski fan. If you haven’t seen the movie, this is Walter – a raucous, erratically-tempered bowling nut who has had it with a fellow bowler who broke the rules by stepping over the alley line. He’s frustrated as all get out and won’t stand for it.

Ever felt this frustrated when looking over your mineral and royalty statements?

You’re not the only one. I hear time and time again from clients who inherited mineral and royalty interests and after receiving their statements they get cross-eyed from trying to make out what the decimals and numbers really mean.

The Truth

Royalty statements may look complicated at first glance, but they’re really not that difficult to understand with a little bit of guidance. Once you start understanding a few key pieces of information, it’s not so bad.

“Understanding your royalty statement is absolutely essential to ensure you are being compensated accurately and fairly for your attributable mineral and/or royalty interest.”

Why They’re Important to Understand

It’s also important to know that not all operators issue royalty statements that look exactly the same; most have the same type and amount of info, but it’s usually presented in a similar, yet different way. Some are going to have more info and some a bit less, some will be made easier to read and well, some will make it very difficult to read and much less easy to understand. In fact, it is a common theory that oil and gas companies make their revenue statements difficult to read on purpose so the person receiving it won’t be able to easily spot errors and miscalculations (which happens quite often and there are numerous law firms out there making a very good living helping mineral and royalty owners recoup back incorrect payments).

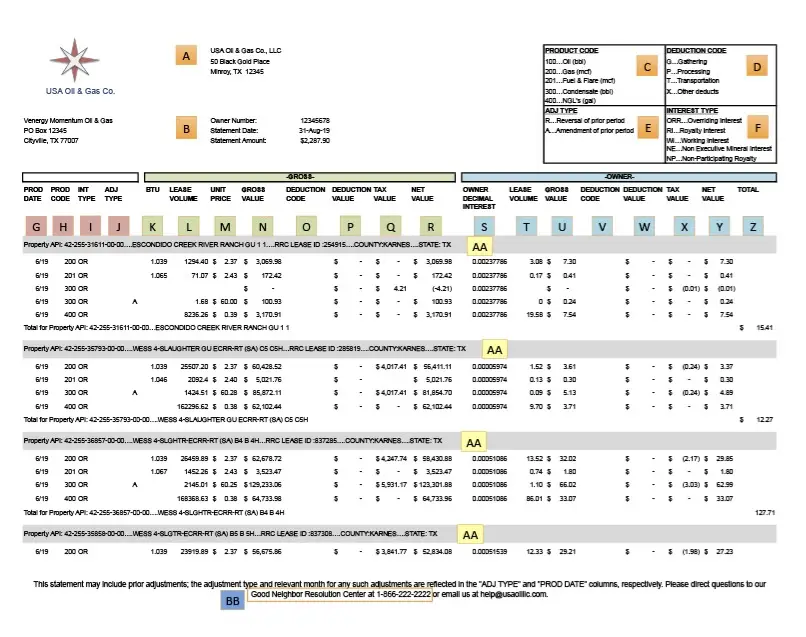

Without further ado, I’m going to give you insight and arm you with the know-how to read and understand your royalty statement as well as help ensure you are being paid accurately and fairly. To make this easy-peasy, I provided a sample revenue statement with the corresponding explanations of each section below. Feel free to print this out when you’re overlooking your own revenue statements.

A Word of Advice…

If you start noticing changes in the look of your royalty statement and from month to month the numbers change dramatically, find a professional that can help you understand what changes have been made and whether they’re significant to ensure you are being compensated accurately based on the terms and conditions of your Lease Agreement. Heck, sometimes I admit that even though I work in this business I have to look up what certain items mean because something has changed in my royalty statement. When this does happen (and chances are it will), it’s a good time to find a copy of your lease for a fresh review and analysis.

A. Operating Company – The entity responsible for sending your royalty checks.

B. Recipient Details (YOU) – This is your Name or Company Name, Address, and ID# or Owner #, Statement Date, and Monthly Payment Amount – This set of information will likely be required when contacting your payor or accessing your payor’s services online.

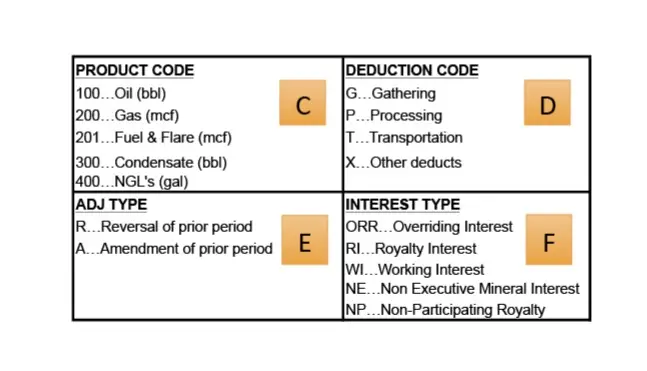

C. Product Code or Types – (These codes, 100, 200, 300, etc. are fairly uniform over the industry)

- Oil (100) – A mixture of hydrocarbons that exist in the liquid phase in natural underground reservoirs and remains liquid at atmospheric pressure and ambient or elevated temperature after passing through surface separation facilities. Quantity is measured in barrels (BBLs)

- Natural Gas (200) – A naturally occurring hydrocarbon in the gaseous phase or in solution with hydrocarbon liquids in geologic formations beneath the earth’s surface. The principal hydrocarbon constituent is methane. It is measured in Thousands of Cubic Feet (MCF)

- Fuel or Flare Gas (201) – Gas production that is either flared off (for several reasons) or is used as fuel for certain operations but nonetheless still requires to be paid as royalty income.

- Condensate (300) – Condensate is a very light hydrocarbon with an American Petroleum Institute (API) specific gravity of greater than 50 degrees and less than 80 degrees. In underground formations, condensate can exist separately from the crude oil or dissolved in oil. It is sometimes referred to as “wet gas”. It can often get a premium over regular crude.

- Production Products (301) – Natural gas liquids recovered from natural gas during processing. Production Products include ethane, propane, butanes, butanes-propane mixtures, natural gasoline and plant condensates, sulphur, carbon dioxide, nitrogen and helium.

- Casinghead Gas or NGL’s (400) – A natural gas that is generated during the oil-drilling process. The natural gas manifests at the wellhead where the oil transitions from underground to surface.

D. Deduction Type / Code –

- Transportation Deduction – The cost of gathering and/or transporting hydrocarbons from the wellhead to a down-stream point of delivery (in most cases, a refinery)

- Dehydration Deduction – A charge for the removal of water vapor from natural gas

- Compression Deduction – The cost to compress gas to a sufficient pressure to enter into a pipeline.

- Processing Deduction – A charge for expenses related to further refinement of high BTU natural gas

- Gathering Deduction – Sometimes you will see this charge if a gas-lift (pumping system) is used to facilitate recovery of oil and gas

- Misc. Deduction – Any other deductions specific to an oil and gas operator enhancing the product for sale

E. Adjustment Type / Code – Believe it or not, even though majority of this information is entered into a computer and uses specific software that does all kinds of calculations, there is still a need for your own accounting of royalty payment errors and adjustments. There are some months where you might be paid more than what you were owed and some months you might be paid less. This is partly due to the constant fluctuations in oil and gas prices on a day to day basis, changes in tax policy, accounting policies, etc. To behoove you it would be good practice to double-check your payments on a monthly or even a yearly basis.

- (R) Reversal of Prior Period – Reversing entries are made on the first day of an accounting period to remove accrual adjusting entries that were made at the end of the previous accounting period. Two benefits of using reversing entries are:

– It greatly reduces the chance of double-counting revenues and/or expenses, and

– It allows for more efficient processing of the actual invoices that will be processed in the new accounting period

- (A) Adjustment of Prior Period – A prior period adjustment is the correction of an accounting error that occurred in the past and was reported on a prior year’s financial statement, net of income taxes. In other words, it’s a way to go back and fix past financial statements that were misstated because of a reporting error. Prior period adjustments are used to fix mathematical errors, improper accounting methods, and overlooked facts in past periods.

F. Interest Type –

- R – Royalty An interest in an oil and natural gas lease that gives the owner of the interest the right to receive a portion of the production from the leased acreage (or of the proceeds of the sale thereof), but generally does not require the owner to pay any portion of the costs of drilling or operating the wells on the leased acreage.

- WI – Working Interest – A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit. After royalties are paid, the working interest also entitles its owner to share in production revenues with other working interest holders, based on the percentage of working interest owned.

- OR – Overriding Royalty – An OR is a fractional, undivided interest with the right to receive proceeds from the sale of oil and/or gas. It is not an interest in the minerals, but an interest in the proceeds or revenue from the oil & gas minerals sold. The interest is limited to a particular tract of land and is bound to the term limits of the existing lease. An OR expires when the oil and gas lease expires.

- RU – Non-Participating Royalty -A Non-Participating Royalty is like a regular royalty in that you receive a share of gross proceeds from the well. The difference is the NPRI owner has no right to negotiate or execute oil and gas leases, no right to receive bonus payments or delay rentals, and no right to develop and produce the minerals him(her)self.

- SO – Surface Owner As a surface owner, the oil company should compensate you for damage and surface occupation during operations. This can be structured as a one-time lump-sum or a monthly payment

- PP – Production Payment A production payment (PP) deal is a type of financing used in the oil and gas industry. A PP involves the owner of oil and gas minerals pre-selling a percentage of their production in exchange for an upfront cash payment.

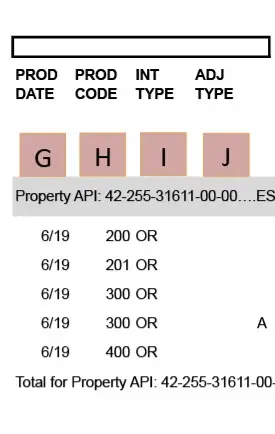

G. Production Date – This column shows the dates of production, in this case, the month and the year. Most statements only give you what was produced on a monthly basis, although, some actually give you the specific day in which the production came about. In some cases, there may be a date from a month or two previous because an adjustment has been made. These adjustments are typically small and can be either an addition or a subtraction to your revenue.

H. Product Code (refer to C) – This shows which product is being produced from each well in that particular month and the revenue associated therewith. It has to be broken down separately due to each product fetching a different value in the market.

I. Interest Type (refer to F) – This shows what kind of interest you have in the well, whether it be a Royalty, Overriding Royalty, Working, Non-Executive Mineral, Non-Participating Royalty, Surface Owner, or if it’s a Production Payment.

J. Adjustment Type (refer to E) – These are additional codes for other deductions commonly found in royalty statements. They may or may not be the same from operator to operator.

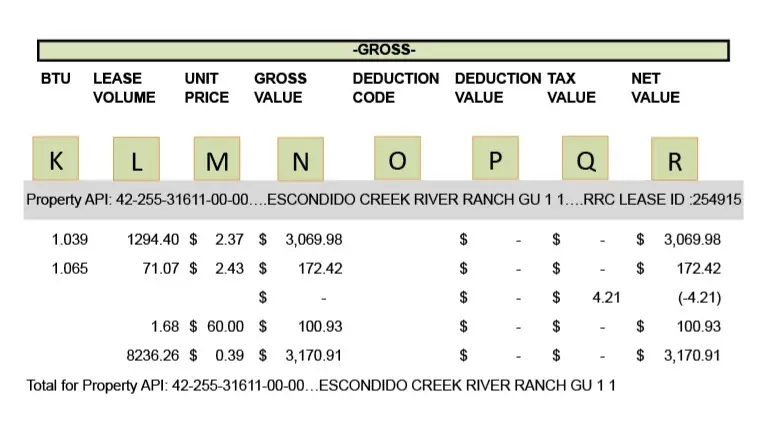

This next section (K through R) contains all information related to the entire drilling unit. It shows all oil and gas production, deduction, and taxes paid. This box is shared proportionately with every interest owner in the unit.

K. BTU Factor – Since natural gas is in fact usually a mixture of methane, ethane, propane, and other hydrocarbons, its Btu content often exceeds 1,000 Btu’s per cubic foot. Since natural gas is sold by the MMBtu, one must measure not only its volume but its Btu content. The Btu content of gas is measured by taking a sample and having it analyzed to determine its constituents of hydrocarbons. This is done periodically for each well, once or twice a year, since the hydrocarbon content of gas from a particular well usually does not change materially over time. Exploration companies must report their production of natural gas on royalty checks in mcf, even though the actual price is based on Btu’s. In order to know the price per MMBtu, you must know the Btu content of the gas. Some companies include that information on their check details. If not, the company should provide that information if asked.

L. Lease Volume – In this case, the Lease Volume is how much of a certain product is produced from the Lease.

M. Unit Price – The price received for the hydrocarbon produced when sold. Prices change daily, so this is an average over the period.

N. Gross Value – This is the gross value from what was produced and sold from each drilling unit.

O. Deduction Code (refer to D) – These codes indicate the type of deduction used in bringing the respective product to market.

P. Deduction Value – In the case above, there happens to not be any deductions for this particular revenue statement, however if there were, the value of that particular deduction would be shown here.

Q. Tax Value – There are state taxes deducted from the gross proceeds of oil and gas produced within the spacing unit. This value is also shared proportionately among all interest owners in the unit. You can check with your local taxing authority to make sure you’re being taxed appropriately.

R. Net Value – Naturally, this is exactly that, the net value of the Gross Value of the product once sold minus any Deductions.

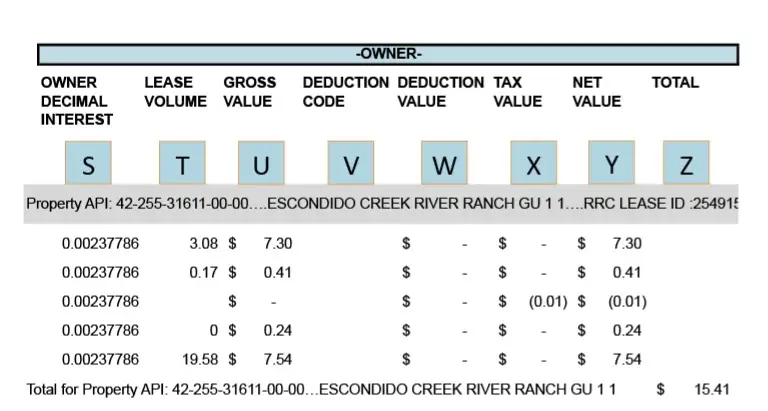

This next section (S through Z) contains the breakdown of your particular share of the spacing or drilling unit. It shows your proportionate share of oil and gas production, deduction, and taxes paid. This box is YOUR individual information and is NOT shared proportionately with every interest owner in the unit.

S. Owner Decimal Interest – This is your percentage share of a spacing or drilling unit that you own. It is used to calculate your proportional share of gross revenue, taxes, and deductions. It is VERY important that you are certain this number is correct as it represents your interest in the unit. The number is derived from 4 factors:

- Your land tract size,

- Your mineral interest percentage,

- Your lease royalty fraction, and

- The size of the producing unit

T. Lease Volume – In this case, the Lease Volume is how much of a certain product is produced from the Lease.

U. Gross Value – This is the owner gross income from what was produced and sold within the spacing or drilling unit. This number is derived by multiplying the Gross Value by the Owner Decimal Interest (N x S).

V. Deduction Code (refer to D) – These codes indicate the type of deduction used in bringing the respective product to market.

W. Deduction Value – In the case above, there happens to not be any deductions for this particular revenue statement, however if there were, the value of that particular deduction would be shown here.

X. Tax Value – This is your share of taxes for the spacing or drilling unit. This number is derived by multiplying the Gross Tax Value by the Owner Decimal Interest (Q x S).

Y. Net Value – Naturally, this is exactly that, the net value of the Gross Value of the product once sold minus any Deductions.

Z. Total – The Net Value from what is left over after any Deductions are subtracted from the Gross Value. This is your monthly revenue total.

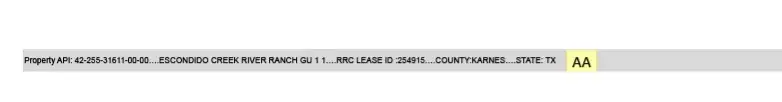

AA. Well Specifics – Well Name, API# and/or Lease ID, County and State of well location.

BB. Owner Relations Contact Number – This is the number you call if there is an issue with your check or statements. You will likely be asked to verify your information and you’ll need to provide your owner ID.

That’s all folks! Not so bad, was it?

By the way, have you checked out our FAQ page? We have tons of Q&A’s in an easy to understand format to help you gain more knowledge about minerals and royalties.

As always, we’re here if you need us! Schedule a consultation today if you need more help or have further questions or fill out the form below and we will get in touch with you.

Leave a Comment