With Venergy Momentum, you can jump into the world of mineral rights investments. With an A+ rating from the Better Business Bureau and great reviews on Google, we know the US mineral and royalty market very well.The vast U.S. landscape, which is full of both federally and privately owned land, makes mineral and royalty rights investments very profitable in many ways. Check out our full range of services or set up a consultation to take advantage of these opportunities.

Understanding Mineral Rights

Mineral rights are key to tapping into underground resources like oil, gas, and minerals, offering the potential for significant passive income. It’s crucial to understand the distinctions between mineral rights, surface rights, and royalty rights prior to considering investing in these assets.

Pre-Purchase Considerations

The property’s location and geological features critically influence mineral rights’ value. Regions such as the Permian Basin, Austin Chalk, and Haynesville Shale in Texas present unique investment opportunities and challenges. Conduct thorough evaluations and ensure you’re well-acquainted with Texas mineral rights laws for risk assessment and informed decision-making.

How much do mineral rights sell for in the Permian Basin?

How much do mineral rights sell for in the Austin Chalk South Texas?

How much do mineral rights sell for in the Haynesville Shale?

Valuation and Investment Strategy

A strategic approach to mineral rights investment in Texas involves understanding market dynamics and geological potential across regions. Diversifying your portfolio across different areas and commodities can mitigate the risks associated with price fluctuations. Collaborating with mineral rights consultants in Texas offers expert insights for valuation and strategic planning.

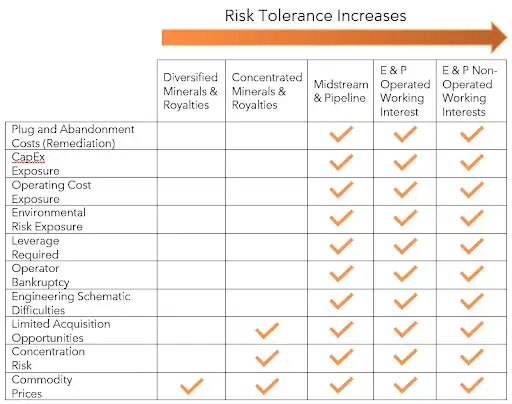

This visual guide helps clarify that as you move from diversified mineral and royalty holdings to direct involvement in exploration and production (E&P), both the potential risks and management complexities can increase. By showing a range of investment types, from passive royalty income to active operational management, investors can see where their interests might fit along the spectrum of risk tolerance and potential reward. It’s a strategic tool that aids in deciding how to balance a portfolio within the oil and gas sector. For a more in-depth understanding, engaging with seasoned mineral rights consultants in Texas can provide tailored advice.

Navigating the Purchase Process

The process involves identifying potential investments and successfully closing deals, with due diligence and professional guidance crucial for navigating Texas mineral rights laws effectively. If you want to learn more about how to buy mineral rights, including specific tips for places like the Permian Basin and the Haynesville Shale, please schedule a consultation.

Post-Purchase Management

Effective post-purchase management of mineral rights includes overseeing operations, staying informed about Texas mineral royalty rates, and being ready for annual expenses and taxes. This strategic approach ensures your investment remains profitable over time.

Conclusion

With the help and advice of Venergy Momentum, you can start investing in mineral rights. We’re dedicated to making sure your venture into mineral rights is both well-informed and successful. Find out how our services can help you reach your goals, set up a one-on-one meeting with us today.

Leave a Comment