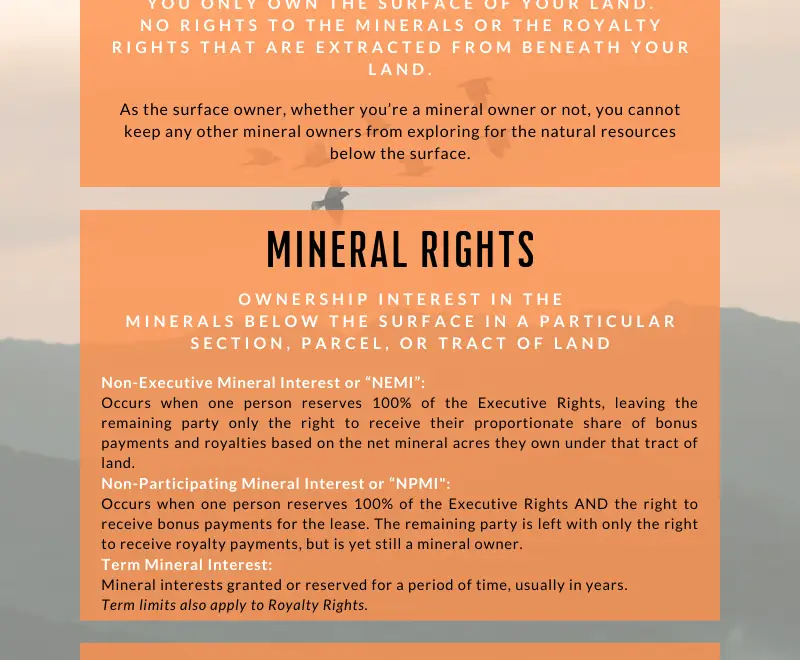

Infographic – Surface, Mineral, Executive & Royalty Rights

These terms are becoming more prevalent in our day and age and starting to gain a lot more attention, especially by venture capitalists and institutional, private, and passive investors looking for a safe place to invest with a minimal amount of risk. These terms are often used in a confusing way and the definitions tend […]

7 Smart Reasons to Sell your Mineral & Royalty Rights

There are any number of reasons why an individual, family, family trust, company, or institution might want/need to divest some or even all their mineral and royalty assets. Here are a few of our own that you can consider: 1. Diversification and Portfolio Restructuring Most every person or entity with mineral and royalty assets […]

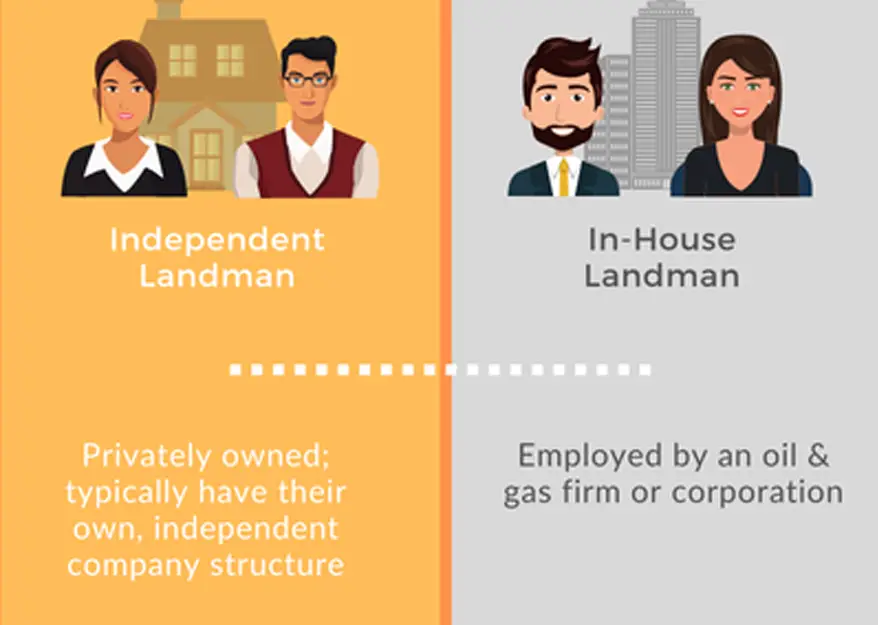

In-House vs. Independent Landman: Which One is Best?

In-House Landmen and women are employed by an oil and gas firm or corporation. They are not allowed to, and do not, receive bonus payments or royalty dividends since their duty is to represent the company they work for. They do all the necessary legwork under the direction and management of the company they represent. […]

Common Oil & Gas Terms

Get your metal lunchboxes and backpacks ready. It’s back to school with Oil and Gas definitions! Also, be sure to check out of FAQ page! There you will find a wealth of information with Q&A’s related to all things minerals and royalties. Abandoned Well-A well that is not being used either because it was a […]

1031 Exchanges – Deferred Taxes, Anyone?

One way to defer capital gains tax on the sale of royalty or mineral interests is through a 1031 Exchange. 1031 refers to the section in the IRS code that allows mineral owners to defer capital gains taxes on the sale of their mineral or royalty rights when exchanged for another qualifying property. The 1031 […]

Dividing family mineral and royalty estate – what you should know

Dividing up family interests is a common practice for any number of reasons, and can be considered an advantage for all parties. Separation of family oil and gas assets can arise for any number of reasons: Family members pass on and their interests need to be divided among heirs Interests were held in a family […]

Infographic – Independent vs. In-House Landman

What’s the difference and which one is best? The answer to this question, like most things oil and gas related, is not cut and dry. Both in-house and independent Landmen are necessary resources and great partners to have when it comes to transacting and negotiating deals. In this blog, I cover the differences between the […]

Landman, Lawyer, or Trustee?

Eeenie, Meenie, Miney, Mo…. In the U.S. it is very common to inherit minerals and royalties from one generation to the next, although they can be transacted, or bought and sold, like any other form of real estate. Those who have become mineral and royalty owners upon inheritance, or as investors new to the business, […]

Hedging Inflation with Minerals and Royalties

Are mineral rights a good investment? Buying Mineral and Royalty Interests as a Hedge Against Inflation Many investors have started to think seriously about gobbling up any investment that could act as a hedge against inflation. It is a topic that should be on most minds, investor or not, at this juncture in time because […]

Shhhh…Personal Advice from a Landman

Hey all! Thanks for taking the next 5–7 minutes to read this hush-hush article. I’ve provided a few tips to help you get educated on the management of your oil and gas assets, the people you may have to work with, and what to look out for. In-House vs. Independent Landman – what’s the […]