This is a question I get asked very often.

Most of the time, clients want to know because they have started to receive offers and/or they are receiving increasing offer amounts for their interests from mineral buyers. This has especially been the case as the price of oil has reached new highs lately.

For others, they may need or want to sell for personal reasons, have been sitting on their asset for quite some time and are starting to consider if they should sell, or they may be just curious as to what kind of offers they could receive.

I wish the answer were simple, but along with many other factors that help answer the question, “How much do mineral rights sell for?”, it also varies based on the stage of development your interests are in.

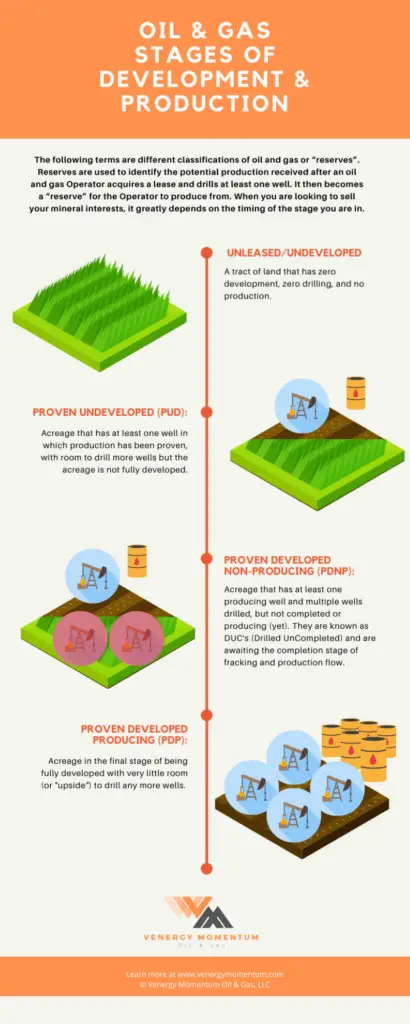

In this blog, we will educate you on the following stages of oil and gas development: Unleased/Undeveloped, Proven Undeveloped (PUD), Proven Developed Producing (PDP), or Proven Developed Non-Producing (PDNP):

What stage of development are your minerals and royalties in?

When is the best time to sell my minerals and royalties?

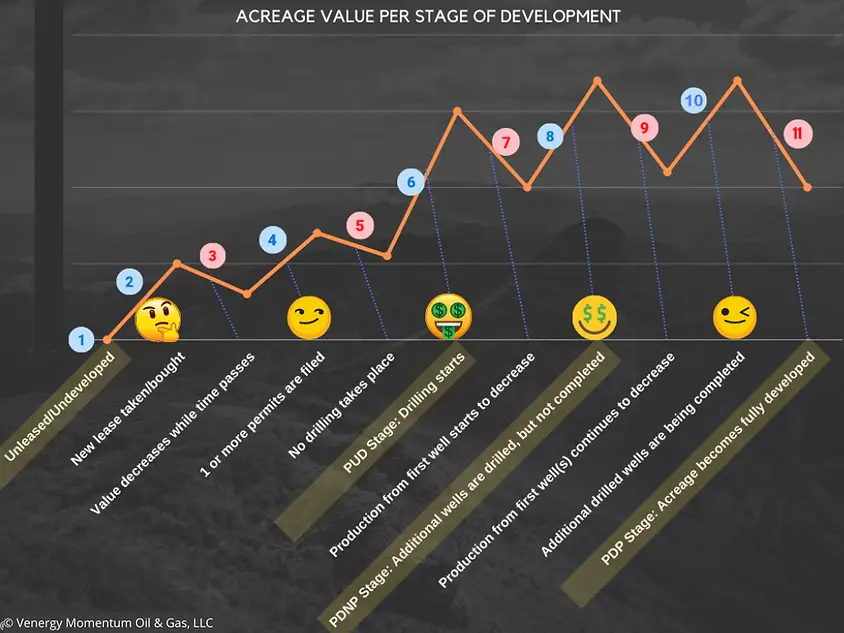

The good news is there are multiple opportunities during these four stages of development but as you can see from the graph below, there are also times when you may want to hold them for a little while longer until some activity starts to shake loose.

But, remember…

Not every area where there is oil and gas is created equal nor is every shale play, some are more productive than others.

It should also be stated that the information described below will change should there be more than one productive zone or horizon (for example, the Permian Basin of west Texas has multiple productive horizons).

The same thoughts outlined below should be applied to the respective productive horizon capable of producing in paying quantities. The only caveat to this would be how long would it take for the Operator to commence development of these additional horizons.

This could honestly, take decades.

The rules of supply and demand, commodity prices, and market cycles also play a huge role and shouldn’t be overlooked. However, for all intent and purpose we’ll simply focus on the four development stages and the selling opportunities therein.

Let’s go through it together:

1 – Unleased/Undeveloped:

At this stage, unless it appears leasing and drilling activity is moving your way, it’s best to sit back and be patient. You don’t want to sell your minerals when they are not worth anything. You aren’t being taxed on them if they are not being developed anyway.

If you are a long-term investor this could be a good time to buy unleased/undeveloped rights if you feel the area they reside in has potential to be developed and if they could be acquired at a good price.

Is this a good time to sell? This would most likely be the least opportune time to sell your mineral rights; you definitely want to wait until one of the next milestones occur.

2 – New lease taken/bought:

When a lease is taken (or bought) by an Operator from the mineral owner, the value of the asset will go up slightly.

Note: the duration and terms of the lease are very important at this stage. It matters greatly if you negotiate a 6-month versus a 3/5/7-year lease. The shorter the lease term, the more likely development is near and imminent. Other factors that add value are:

- Royalty percentage (cost-free, of course), and

- Whether the lease contains (or is absent) a drilling commitment, good pooling and Pugh clauses, and an extension:

If, after the acreage is leased, and no development happens for some time, the value will start to decline as the lease expiration date approaches.

If there is an extension clause in the lease, it could be a deciding factor for a buyer, and they will decide if this extension gives more or less value to the asset. I’ve seen buyers go both ways:

Some buyers will wait to see if the Operator chooses to extend the lease and others will buy it in hopes of getting some money back on their investment.

Chances are, if they do decide to make an offer to purchase your interests, they will attempt to secure the asset at a lower cost.

Other buyers may feel it could be too much of a risk (even though they could receive some extension bonus money) to have their money tied up during this extension period without knowing whether drilling will take place in the future.

Bottom line: A good lease is important!

It will behoove the mineral owner in the long run to have a favorable royalty rate, pooling provision, continuous development, Pugh clauses, and whether a drilling commitment (most likely it won’t be) is dictated in their lease agreement from the start.

This is why it’s good to have a knowledgeable Landman or attorney to assist in the beginning.

Is this a good time to sell? This would be the first milestone one would want to wait for if the thought of selling your mineral rights has crossed your mind; however, it is still not the most opportune time to sell even a percentage of your minerals.

3 – Value decreases while time passes

4 – One or more permits are filed

Alright! An Operator permits a well affecting your interests causing your value to go up a little more. The more permits filed, the more valuable your acreage becomes.

If there are permits filed on adjacent/contiguous lands, this could potentially add value to your interests as well. However, should time start to pass with no drilling activity taking place for a year or more, the value will decline as permits typically expire after one year with no development (Stage 3).

The next opportunity for added value will be when the Operator renews/files new permits and starts drilling.

Is this a good time to sell? This is the second time one would really want to consider selling a percentage of their mineral and/or royalty rights. It’s still not the best timing, that’s coming up.

5 – Should no drilling take place soon, values will continue to decrease as permits expire

6 – PUD Stage: Drilling starts

Oh boy, now it’s about to get interesting.

When an Operator starts drilling one or multiple wells affecting your interests it causes the value to go up exponentially more. While an Operator can only drill one well at a time, they can drill several wells back-to-back.

Hopefully, they have plans to consecutively drill several wells and hopefully they complete (or frack) as many of those wells as possible.

The more wells the Operator initially drills and completes, the higher the value of your interests will go due to the potential buyer receiving the flush production from those wells. What’s most likely to happen is the Operator may only drill one or two wells and then wait for them to start producing so they can analyze the production results from their drilling and completion methods used.

This acreage will now enter the Proven Developed (PDP) and the Proven UnDeveloped (PUD) stages. This is a stage that mineral and royalty buyers both love and hate.

They love the flush production and ROI they will soon be receiving from the acreage classified as PDP but don’t like that mineral and royalty owners will expect them to pay handsomely for the acreage that is not yet producing, the PUD acreage.

Nowadays, mineral and royalty buyers don’t like to attribute much value to the Proven UnDeveloped (PUD) acreage, but they will pay for it so long as the seller expectations for the non-producing interests are not over inflated.

The only acreage mineral and royalty buyers like to give value to is the producing acreage. For the rest of the non-producing PUD acreage, they may offer a little value, but will not pay a lot for it.

However, this is not always the case as I always say:

“Something is only worth what someone is willing to pay for it”.

By these standards, a mineral and royalty buyer may find value in paying up for PUD acreage based on the potential future value if an Operator starts going into the development stage.

Should an Operator start developing the PUD acreage, the value of your interests at that point far exceeds what most mineral and royalty buyers would be willing to pay.

Whether they pay very little or pay up, they will consider timing and the future value. (Note: the wells that don’t get completed at this time are now called Drilled, UnCompleted wells (DUCs)).

Is this a good time to sell? At this stage, values that mineral and royalty buyers throw out may range greatly as the results from the newly drilled wells are somewhat uncertain and the acreage has not been de-risked yet.

Should you choose to sell at this point, it would be best to only sell a percentage of your interests and at the highest price possible. Seriously, the absolute highest price possible and you will want to have an experienced Landman assisting you in the process!

This will allow you the opportunity of taking some cash and substantial level of risk off the table while hedging your bets on future potential.

This could potentially be one of the best times to sell provided you have a mineral and royalty buyer willing to pay up for not only the soon to be producing acreage but also the acreage the DUCs and other non-producing acreage covers.

Another thing to consider is that once the Operator drills and completes one to two wells, your interests may be considered Held by Production (HBP). This means the Operator has fulfilled their drilling obligations for the foreseeable future with nothing forcing them to come back and drill any new wells.

This is not what you want.

Let’s say you negotiated a three-year lease and in year two the Operator drills two wells thereby fulfilling their drilling obligations per the terms and conditions of your lease and at the same time HBP’ing your interests. This could afford the Operator the opportunity to sit back and possibly wait another 10 years completely passing up the expiration of your three-year lease so long as the wells continue to produce in paying quantities before they may want to come back and drill again.

Is this to say that mineral and royalty buyers won’t want to buy your interest? They more than likely will, they just won’t pay top dollar prices for it.

Again, you need a good Landman or attorney to help negotiate a good lease in the beginning to get the best terms on your behalf.

7 – Production from first well(s) start to decrease, as do values

8 – PDNP Stage: Additional wells drilled, but not completed

Moving forward, if the Operator happened to drill several wells and only completed a few (one to two) of those wells, the acreage as a whole is now considered to be Proven Developed, Non-Producing (PDNP).

Mineral and royalty buyers everywhere are going to be watching the results of those newly completed wells very carefully.

Should those wells turn out good, those same mineral and royalty buyers are going to make haste and start contacting other mineral and royalty owners affected by those wells and contiguous/surrounding acreage in the area.

After approximately the first eight to ten months initial production, the value of your interests will start to decline as production continues to flow (as the product is being produced/drained from the acreage affecting your interests).

At this point, should the Operator fail to return to complete any of those DUCs, the acreage value will start to sharply decline. The more time that passes, your interests will bleed off value as the wells decline rate starts to level off, at which point the value of your interests will be based more on a PDP value as mentioned above in stage 6.

Is this a good time to sell? This could still be a good time to sell a percentage of your interests.

However, the better time would have been while the drilling activity was fresh as mineral and royalty buyers apply great consideration to the time value of money and their ROI.

Naturally, just like any investment, the buyer wants to start making as much money as possible and as quickly as possible and it’s no different when buying and selling minerals and royalties.

Mineral and royalty buyers pretty much know what to expect from any new wells and they apply a cap to what they would be willing to pay to acquire new or additional interests under acreage that has achieved this level of production or classification, PDP and PDNP.

9 – Production from first well(s) continues to decrease

10 – Additional drilled wells are being completed

The Operator has decided to return, they are completing any DUCs and going to drill and complete the last few wells thereby fully developing the acreage.

It should go without saying now that two things are going to happen:

- The value of your interests is going to go up again. How much it goes up will be dependent on how many new wells are being completed and new wells drilled and completed.

- Word will get out fast those DUCs are going into their completion stages thereby setting the stage for new and flush production and heightened mineral and royalty buyer activity once again.

Is this a good time to sell? Once again, mineral and royalty buyers will know what kind of production to expect from the new wells and they can and will apply a cap to what they would be willing to pay for new or additional interests under this acreage.

It’s still not a bad time to sell, however, unfortunately it is also not likely you will get what you feel the property could be worth and what a buyer is willing to pay will typically not be in line with your expectations (I explain more about this further).

11 – PDP Stage: Acreage becomes fully developed

As the Operator finishes the drilling and completion of the last few wells, they reach full development and the wells start producing, the value of your interests will drop substantially as the well production declines.

Horizontal wells typically decline at a faster rate than vertical wells and produce a steeper decline curve before leveling out (yet still declining), which every mineral and royalty buyer will consider when making any offers to purchase.

Again, the buyer offer price and seller expectations will most likely not be in line.

“At every milestone development there is time to sell and a time to wait.”

Want to talk about it instead? Schedule a consultation.

Selling Minerals and Royalties

Understanding the Buyer/Seller Gap

It is very rare for mineral and royalty buyers and sellers to agree on how mineral and royalty interests should be valued.

The gap between buyer and seller expectations is typically the size of the Grand Canyon at best before the two come close to an agreed value.

If this happens, the buyer usually will come up slightly in price but most of the time the seller is the one that must lower their expectations more than what the buyer is willing to come up in value.

It’s rare for the seller to have total control and have buyers bend to their will with inflated asking prices. The best opportunity for sellers to get the most value would be starting at stages 6-8.

The reason why I stated at both Stage 10 and 11 the seller’s expectations won’t be in line with the buyer’s offer is because 99.9% they aren’t (generally speaking, this really goes for any stage)!

Here are a few reasons as to why:

1. Sellers are not familiar with the various production stages of developing oil and gas minerals nor are they completely understanding or knowledgeable about how to value minerals and royalties in each stage of development. Most sellers think oil and gas production will continue forever while also knowing that it is a declining asset. Kind of weird.

Bottom line: Sellers should know their asset inside and out, know the market, and what direction buyers are heading. Speak to a Landman or attorney specific to your interests if you need help. It will save you a lot of time and headaches!

2. Sellers want top dollar for every drop of oil or gas that could be squeezed from beneath their property when in fact, no Operator will ever be able to produce and extract every single drop or barrel of oil or mcf of gas from the land. At some point, it will not be economic to even attempt producing the acreage any further.

Bottom line: Buyers can’t and won’t compensate sellers for every drop of production their interests are capable of producing.

3. Most (not all) buyers are considered aggregators, meaning they will buy several different assets and when they feel they have a good enough bundle of assets to sell, they will sell to a larger mineral and royalty buyer and then they’ll do it again and again. But no matter what, any aggregator/buyer will apply the decline rate of each well affecting your interests, apply that same decline rate to any future wells, and try to apply some timeframe when future development may take place. It greatly depends on past development, how much room is left for future development, and some guess work unless they have some other inside info regarding the Operator’s plans. They will go through this same process again and again when they go to sell their assets or fund to a larger buyer.

4. On top of not paying for all the production a property can produce while also applying the decline curve of each well, the price buyers are willing to pay is further reduced based on their risk vs. reward metrics. While reducing the price they can pay even further so they can make a good ROI while it is going through its various production stages. The price could be reduced even further because when it’s time for the buyer to then become the seller, they’ll want to make money when they go to sell the asset. Most buyers have some time frame in mind and know about when they would be willing to divest of their assets even before they start buying. Not to mention, buyers usually have overhead like employee salaries, office space, and other operating costs they must pay.

Bottom line: Buyers can’t pay what sellers typically want, they just can’t. There must be enough “meat on the bone” for when the buyers choose to sell.

5. Sellers don’t really care about what hoops the buyers have to jump through. Sellers typically want what they want, however, at the end of the day something is only worth what someone is willing to pay for it and this goes for anything.

Bottom line: Sellers need to consider all aspects of the development, production, and business of being a mineral and royalty buyer. It’s more than what they think and there is a considerable level of risk that needs to be taken into account.

Wrapping Up

You will notice that I have not once mentioned during any of the declining stages that it would be an opportune time to sell any of your mineral and/or royalty interests.

One should, at all costs, wait for one of the important milestones described herein to consider selling some or all their interests.

It should also be mentioned that everyone’s situation is different, and life happens to us all. Should something come up or happen, it’s important to understand what stage of development your interests are in at any given time.

When you have this understanding, you can be more realistic about what to expect should you need to sell or simply choose to sell. I hope this article help does that for you.

To recap with some fun:

Acreage Value Per Stage of Oil and Gas Development

It is equally important to know that owning mineral and royalty interests come with great responsibility and should always be treated as an asset.

Forget any emotional attachment as it would be more wrong to not take advantage of selling some or all your interests if it makes sense: to deny a son or daughter, niece or nephew, or grandson or granddaughter a chance to go to college, to be strapped for money and allow yourself to drive an unsafe vehicle, or allow yourself to file bankruptcy, and heaven forbid, allow yourself to lose this incredible asset to the bank over something foolish like not selling some of your mineral and/or royalty interests when the need and opportunity presented itself.

There could be countless reasons why one would want to sell some or all their mineral and/or royalty interests.

Everyone’s situation is different.

In addition to the information included here, there is also a people component to buying and selling minerals and royalties.

I mentioned a couple of times throughout that you should have an experienced Landman or attorney helping you along the way. A professional with a close network of top industry buyers they regularly do deals with can help you get top dollar for your interests, help manage the process, and make your experience more enjoyable.

Thanks for hanging in there with me. I know this is a lot; my aim is to help mineral and royalty owners make smart and confident decisions with their interests. Contact us today if you need further help and don’t forget to visit our FAQ page where we cover a wide range of topics.

Leave a Comment