👉 Ready to evaluate your options? Schedule a Consultation

Should I Sell My Minerals and Royalties?

“Should I sell my minerals and royalties?” This is a question I get asked very often.

Most of the time, clients want to know because they have started to receive offers for mineral rights or increasing values from mineral buyers. For others, the reasons vary:

- They may need or want to sell for personal reasons.

- They have held their assets for a long time and are starting to reconsider.

- They may simply be curious of what mineral price offers they could receive.

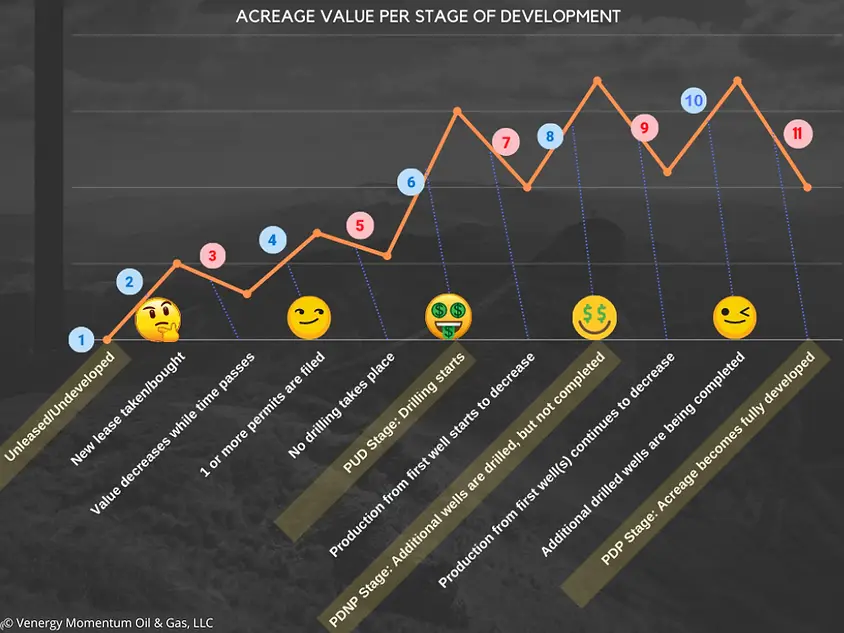

Unfortunately, there’s no simple answer. Your mineral rights’ value—and the right time to sell—depends largely, but not solely, on the stage of oil and gas development your interests are in.

At every milestone development, there is a time to sell and a time to wait.

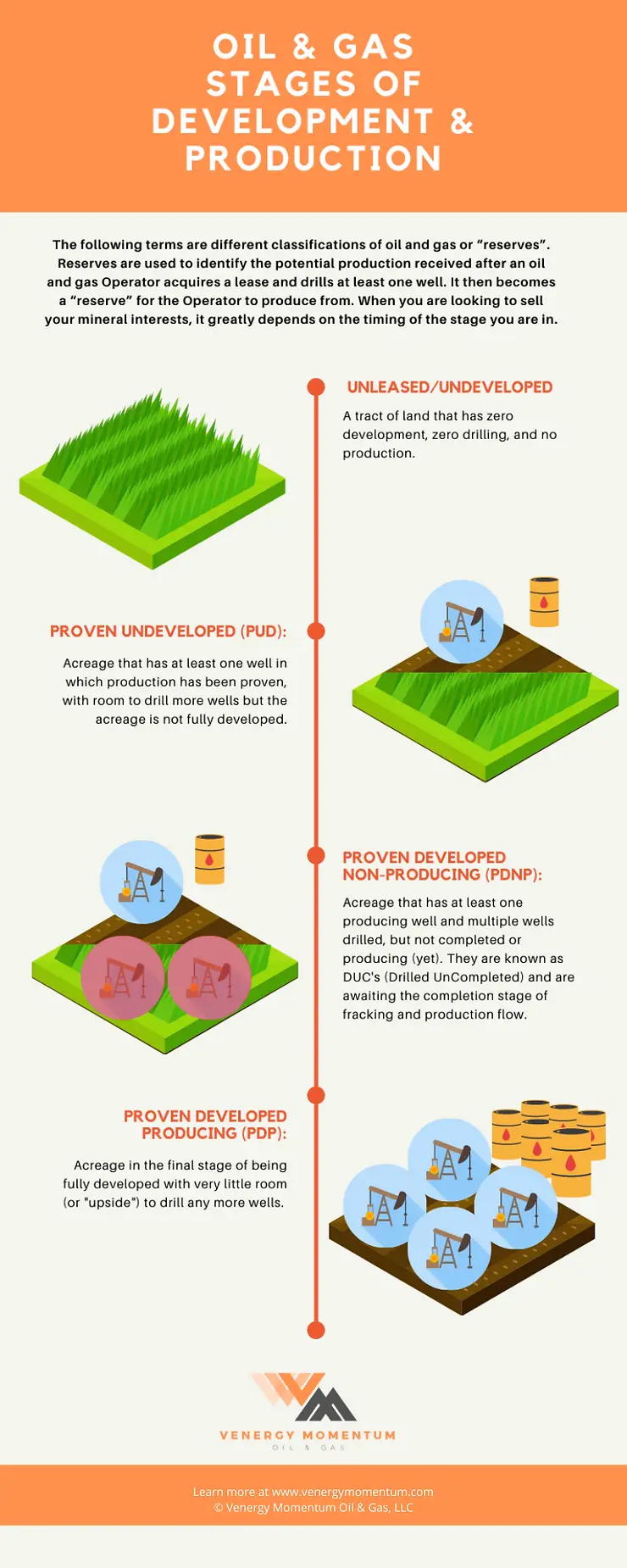

In this blog, we will walk through the key stages of oil and gas lease development:

- Unleased/Undeveloped

- Proven Undeveloped (PUD)

- Proven Developed Non-Producing (PDNP)

- Proven Developed Producing (PDP)

🏞 Stage 1 – Unleased/Undeveloped

Activity: No lease. No drilling. No production.

Unless oil and gas leasing and drilling activity is moving your way, it’s best to sit back and be patient. Selling now would bring minimal value since the minerals aren’t generating income. You’re also not being taxed on them if they aren’t being developed.

Watch our short video: Mineral Rights and Your Taxes.

Investor Insight: For long-term investors, this can be a good time to buy mineral rights—if the area shows potential.

Is this a good time to sell? No. This is likely the least opportune time.

✍️ Stage 2 – New Lease Taken or Bought

When a lease is taken (or bought) by an Operator, the value of mineral rights increases slightly. Lease terms become critical:

- Lease duration: Shorter leases often mean development is near.

- Royalty percentage: Should be between 20-25% with emphasis on the latter and cost-free.

- Clauses: Drilling commitments, pooling, Pugh clauses, and extension terms.

If development stalls, value possibly declines as lease expiration approaches. It will depend on the situation; be sure to discuss it with us.

Is this a good time to sell? This is the first milestone to consider, but still not optimal.

📝 Stage 3 – Value Decreases While Time Passes

If no drilling or additional leasing occurs, value declines steadily.

Is this a good time to sell? No. It’s best to wait for new drilling permits or activity.

📝 Stage 4 – One or More Permits Filed

👉 Curious what your minerals are worth? Schedule a Consultation With Us

An Operator files a permit, increasing value. More permits add more value. Permits on adjacent lands can also boost worth.

If no drilling occurs within a year, permits expire and value declines. This activity must be watched carefully.

Is this a good time to sell? Yes—consider selling a percentage, but the best time is still ahead.

🛑 Stage 5 – No Drilling / Permit Expiration

If no drilling occurs, permits expire and value steadily decreases.

Is this a good time to sell? No, it’s best to wait to see what happens.

🛠 Stage 6 – PUD Stage: Drilling Starts

Drilling significantly increases value. Your acreage enters the Proven Undeveloped (PUD) and Proven Developed Producing (PDP) stages.

- Buyers are cautious about paying for PUD unless expectations are reasonable.

- Buyers love flush production (PDP).

Tip: Sell a percentage and seek the highest price possible with professional guidance.

Is this a good time to sell? Yes—this can be one of the best opportunities.

👉 Considering selling part of your mineral interests? Schedule a Consultation

📉 Stage 7 – Production Declines

As initial wells decline, so does value. Buyers become cautious.

Is this a good time to sell? Possibly, but earlier would have brought better offers.

🔧 Stage 8 – PDNP Stage: Additional Wells Drilled, Not Completed

👉 Need expert advice before making a move? Talk to a Landman

When Operators drill multiple wells but only complete a few these are called DUC’s – Drilled, Uncompleted Wells. Value can drop if remaining wells are delayed.

Is this a good time to sell? Yes—selling a percentage is still viable, though earlier would have yielded better value.

📉 Stage 9 – Production Continues to Decline

As production declines further, value continues to decrease.

Is this a good time to sell? Possibly, but offers will reflect reduced production.

🔨 Stage 10 – Additional Drilled Wells Completed

Operators complete remaining DUCs, increasing value depending on the number and performance of new wells.

Is this a good time to sell? Yes, but buyer offers may not match seller expectations due to production history and depletion from previous wells. Sometimes new wells don’t yield the same results as former wells drilled.

🏭 Stage 11 – PDP Stage: Fully Developed

The acreage reaches full development. As production declines, so does value. Buyers and sellers often have differing expectations.

👉 Read our blog on the critical information sellers need to understand about mineral buyers’ offers.

Is this a good time to sell? Yes, but offers will reflect declining production.

Wrapping Up

At no point during declining stages is it typically wise to sell. Instead, wait for important milestones.

It’s vital for sellers to understand the stage your interests are in to set realistic expectations.

Final Thoughts

Owning mineral and royalty interests comes with responsibility. Avoid emotional attachment—selling may be wise to:

- Fund education.

- Prevent financial hardship.

- Protect assets.

- Implement a tax strategy, like a 1031 exchange into other investment properties of equal or greater value.

Everyone’s situation is different.

A trusted landman familiar with the selling of mineral rights and royalties with an extensive END-BUYER network can help secure top dollar and manage the process smoothly.

👉 Ready to take the next step? Contact Us Today

Thank you for sticking with me. My goal is to help mineral and royalty owners make smart and confident decisions and to keep them from being taken advantage of. I’ve seen it too many times in my career, which is why I started my own company in 2014 to be an advocate for mineral and royalty owners.

Mineral and royalty ownership can be complicated, but we’re here to help.

Contact us today and visit our FAQ page to learn more.

Leave a Comment