Why Sellers and Buyers Disagree on Mineral and Royalty Value (And How to Close the Gap)

Selling minerals and royalties can be exciting — but it often leads to frustration when sellers and buyers disagree on value.

It’s uncommon for both parties to agree without compromise or a professional grasp of the mineral buyer’s perspective. The gap between what sellers hope to receive and what buyers are prepared to pay can seem as vast as the Grand Canyon — and bridging that gap is our specialty. We understand the complexities behind both the offers buyers make and the expectations sellers hold.

In this blog, we’ll break down why this valuation gap exists and what sellers need to understand to help bridge it.

Why Do Buyer and Seller Expectations Differ?

1️⃣ Lack of Knowledge About Production Stages

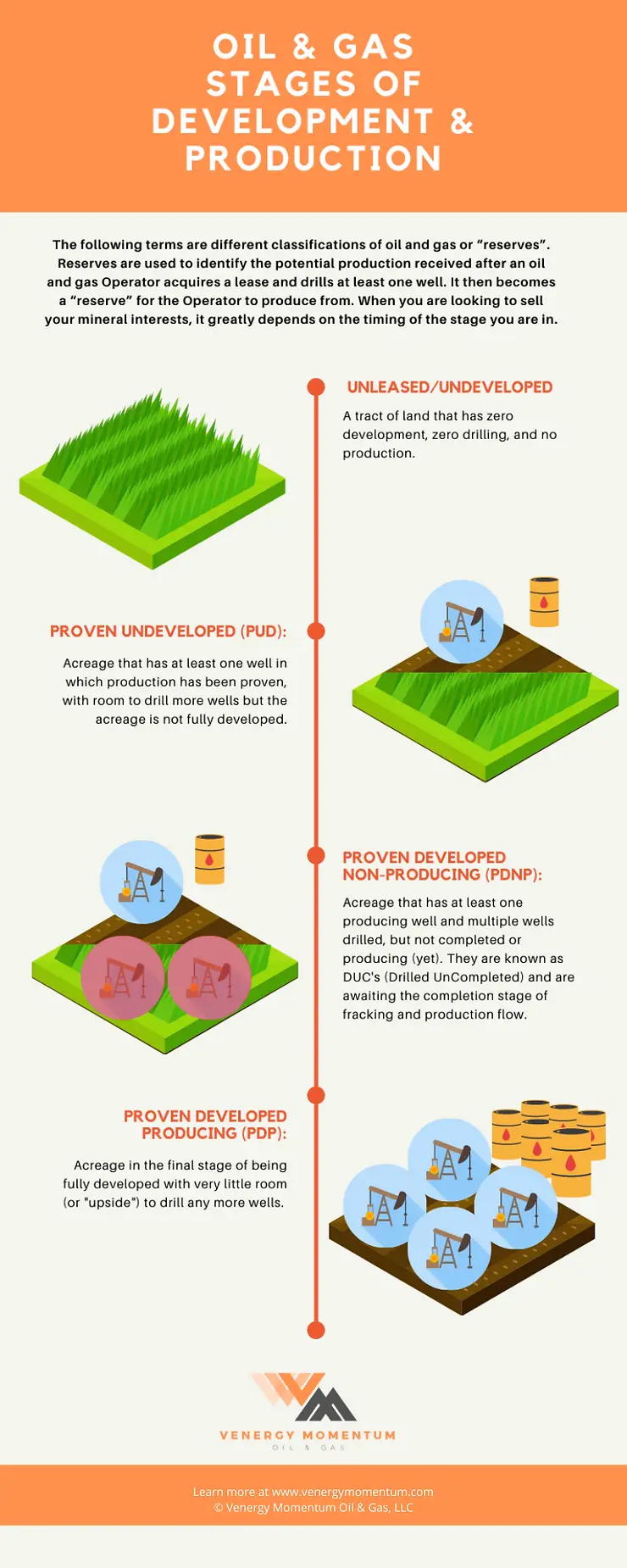

Many mineral owners don’t fully understand how oil and gas development stages impact value.

Sellers often believe production will continue forever, forgetting that mineral assets are declining resources.

Bottom line: Know your asset, know the market, and consult a professional Landman familiar with valuing and selling mineral and royalty assets for expert advice.

Learn about the key stages of oil and gas production in our blog, Selling Mineral Rights: Key Stages and Timing for Maximum Profit

2️⃣ Sellers Expect Maximum Value for Every Drop

Some sellers want to be compensated for every potential barrel of oil or mcf of gas under their land.

In reality, no operator can extract every drop. Eventually, wells become uneconomical to produce.

Bottom line: Buyers can’t and won’t pay for hypothetical future production that may never happen.

3️⃣ Buyers Are Aggregators With Their Own Strategies

Most mineral rights buyers — especially aggregators — purchase multiple assets. They apply:

- Current production decline rates

- Estimates for future drilling

- Predictions for operator activity

They bundle assets together for future resale or portfolio growth, always considering their own risk and timelines.

Bottom line: Buyers factor in risk, uncertainty, and market conditions before making an offer.

4️⃣ Buyers Have Costs and ROI Requirements

Buyers need to cover:

- Employee salaries

- Office space

- Operating costs

Plus, they require a return on investment (ROI). They also plan for when they’ll resell or divest, which means they need room for profit.

Bottom line: There must be enough “meat on the bone” for buyers to profit later. That will always limit what they can pay now.

5️⃣ Sellers Often Overlook Buyer Constraints

Sellers usually focus on what they want — not what buyers need to consider.

At the end of the day (and this is what I always tell my clients):

Something is only worth what someone is willing to pay for it.

Bottom line: Sellers need to understand the business side of mineral rights transactions, not just their expectations.

Wrapping Up

Most sellers will need to adjust expectations to reach a deal. Additionally, based on all the aforementioned buyer parameters, buyers are always at different stages in their portfolio aggregation and fund life cycles. This is why it’s so important to test the market by marketing to a wide range of END BUYERS — because you never know which stage they’re in, and that will certainly affect the strength of their offers.

The best opportunities for sellers typically arise during key milestones, especially at these stages of oil and gas development when buyer interest and mineral value peak.

Pro tip: Work with an experienced Landman or mineral rights sale consultant to:

- Understand your asset’s true value

- Time your sale for maximum return

- Connect with many serious END buyers in their network

Ready to Maximize the Value of Your Minerals and Royalties?

If you’re receiving offers or considering a sale, let’s talk. We’ll help you navigate the market and get the best deal possible. Going at it alone can cost you if you don’t know what you are doing and what to watch out for.

Read our blog, 7 Expert Tips for Selling Minerals and Royalties Safely.

Leave a Comment