As it goes for every sought after investment, a lot of factors go into this answer.

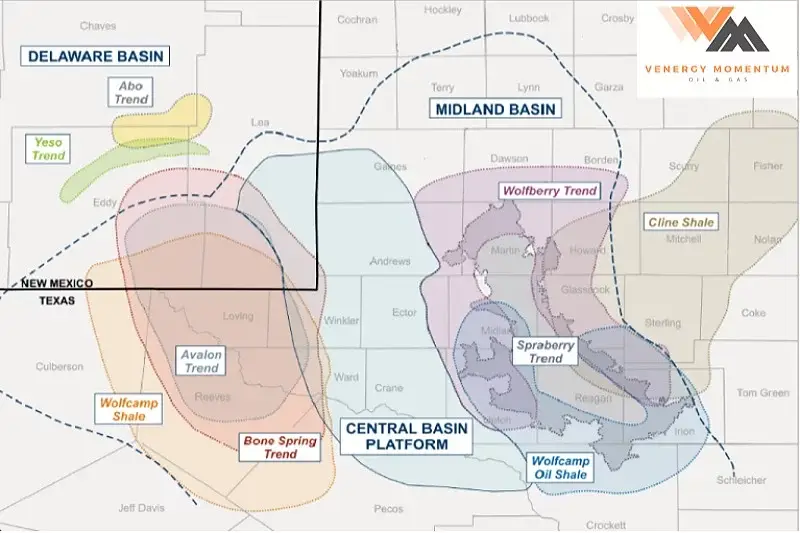

They might be worth a lot more than you think or they might be worth significantly less depending on a few basic pieces to the puzzle. Mineral and royalty buyers today are still looking for and paying very good prices for minerals and royalties in core and key areas of the Permian Basin, however, due to the still depressed demand for oil and gas, the Area of Interest (AOI) or buying area for mineral and royalty buyers has shrunk.

Should you have an asset in the core area, depending on the activities taking place there, your asset prices could still be in the $18k-$25k/NRA valuation range.

Truth be told, the Permian is stronger than ever before now that we know what it is truly capable of producing and from where.

Operators and mineral buyers alike hone in on the most productive and lucrative areas and restrict their buying parameters regularly.

We are seeing activity grow in the following Texas counties: Midland, Martin, western Howard, Upton, Reeves, Loving, and Reagan. In New Mexico, Lee and Eddy counties are experiencing traction.

Whether your minerals are valuable in these areas depends greatly on their stage of development.

Why “never sell your minerals & royalties” is no longer good advice.

Sellers are finally starting to understand that owning minerals and royalties are a big responsibility and the old adage of “never sell your minerals and royalties” is no longer good advice and they’re selling down a portion of their asset(s) while the get’n is still good.

When folks saw the almost instantaneous effects of what the Coronavirus did to oil and gas production, which virtually squashed it over night, they’re not taking any chances holding a vast part of their wealth in the ground.

The other saying of “there will always be another oil boom” will not always be the case either due enormously large forces trying to get rid of this century-old commodity.

It’s important to know the value of your minerals and royalties in a boom, neutral, or bust oil economy. If you were a mineral and/or royalty owner, you saw what a global pandemic can do to royalty checks and values in a short period of time.

It’s always good to be prepared, have the knowledge and power of your wealth in your hands for when values come back up (and they will because they already are in certain areas).

Selling a portion of your interests could be a smart move if you need to respond for any life event and after an evaluation, we can determine what your chances are of receiving bids, what those bids might be, and who might could be interested.

It’s never a bad time to see what your minerals are worth in the free market. Once you have the power in your hands, you can make intelligent and confident decisions about what to do next.

Venergy is here to answer your questions about the state of oil and gas in this prolific area.

Have you visited our FAQ page yet? We include a wealth of information about minerals and royalties there. Check it out.

Fill out the form below if you need some help, or schedule a time speak with us.

The History of the Permian

The Permian Basin, a 250-mile by 300-mile expanse stretching from SE New Mexico and throughout West Texas, has been one of the longest producing and most sought after oil fields in the entire world. The Permian Basin encompasses two New Mexico counties and 17 West Texas counties.

The first commercial oil well to be drilled in the Permian Basin was completed in 1921 in Mitchell County, Texas on the east side of the basin. From 1923 to 1928, several notable, shallow oil fields were discovered giving way to very modest “well control” for the Permian Basin.

A deep test was started and performed in the Big Lake area of Reagan County, Texas and led to a large oil flow which greatly expanded prospects for the Permian Basin to become a major oil & gas producing area.

There are several huge oil fields found throughout the world with the former biggest and most well known being the Ghawar field in Saudi Arabia. For the first time in decades and according to production reports from the EIA, at the end of 2018, the Permian Basin has become the largest producing oil field in the world now surpassing the Ghawar field.

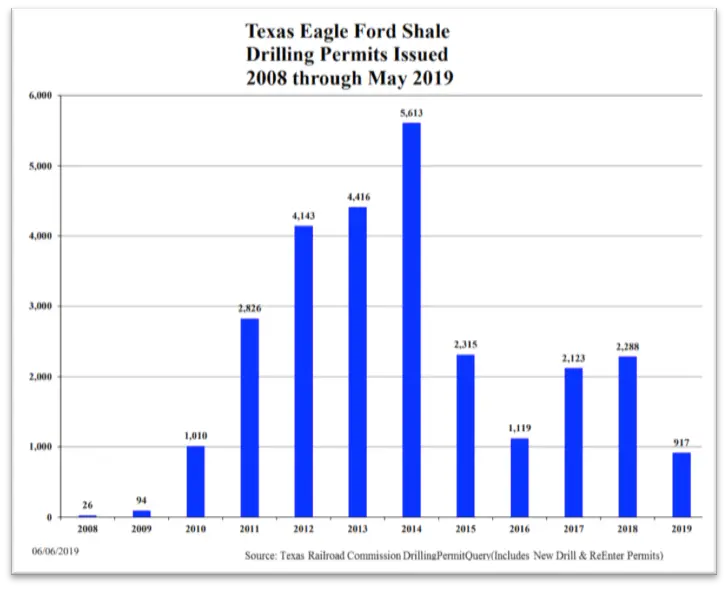

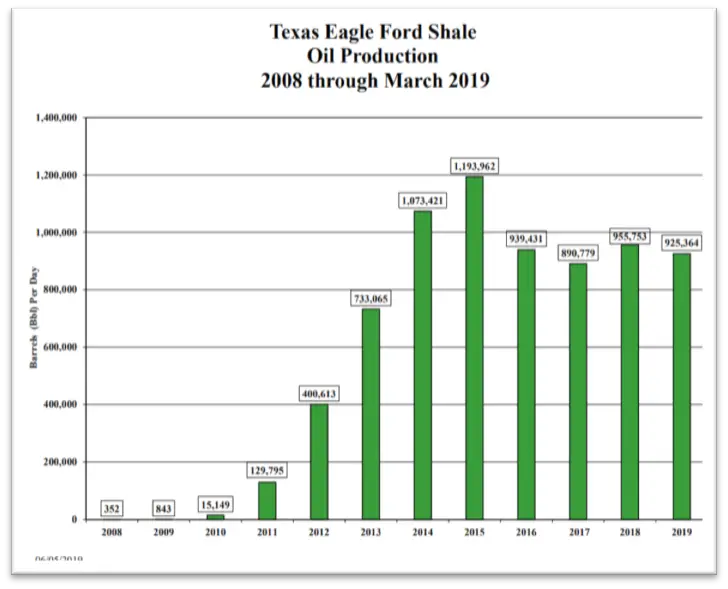

Just check out these drilling permit and production graphs:

This video sums it up for you!

If you need further help or just want to have conversation about what’s going on in the industry, schedule a time to talk with me or fill out the form below and I’ll get in touch with you.

Leave a Comment