-

Inherited Mineral Rights in Louisiana

Inherited Mineral Rights in Louisiana

Inherited Mineral Rights in Louisiana

Inheriting Mineral Rights

The first question that often comes to mind for newly inherited interest owners is, “Are mineral rights valuable?”.

Inherited minerals can be valuable, or they may not be. For new mineral and royalty owners, there can be a lot to learn. The potential tax liabilities, the need for a Retrospective Appraisal, and challenging the old adage to never sell your minerals are just a few of the things new owners should understand.

Inherited Rights?

5 Things You Need to Know

- A Retrospective Appraisal will be necessary to determine the value of your assets upon the date of inheritance.

- Monthly royalty income is taxed at ordinary income levels (~39.5%). However, you can benefit from the lesser capital gains tax rate on the revenue from the sale if they were owned for more than one year. Learn more about Inherited Rights and Your Taxes.

- Owning minerals and royalties requires responsible and detailed records management.

- Minerals and royalties are treated as real property; sellers can therefore utilize the tax-deferred 1031 Exchange to purchase another property of like-kind.

- You don’t have to sell ALL of your mineral and royalty rights. You can keep a portion and sell the rest!

Minerals and royalties are assets and should be treated as an investment.

Once they start producing, they will become a depreciating asset and their value will begin to decrease.

Selling minerals and royalties should be considered when they are worth a significant amount of money;

working with a trusted industry professional who knows how to navigate the sale process is a must.

Don’t Make The #1 Mistake When Selling Minerals

Considering only one (or even two or three) offers from a mineral buyer is NOT the best way to determine what your mineral rights are worth!

Why not test a wide range of offers from many mineral-buying companies?

At Venergy, we have a 95% transaction success rate and it’s because we know that the only way to truly see how much your minerals are worth is to see what many buyers are willing to pay for them, not just a few.

How Much Do Mineral Rights Sell For in Louisiana?

There is no straight and easy answer when it comes to determining mineral rights value. Mineral buying companies in Louisiana that claim to give you a fast, click-of-a-button offer value for your minerals are just that, a click-and-bait tactic.

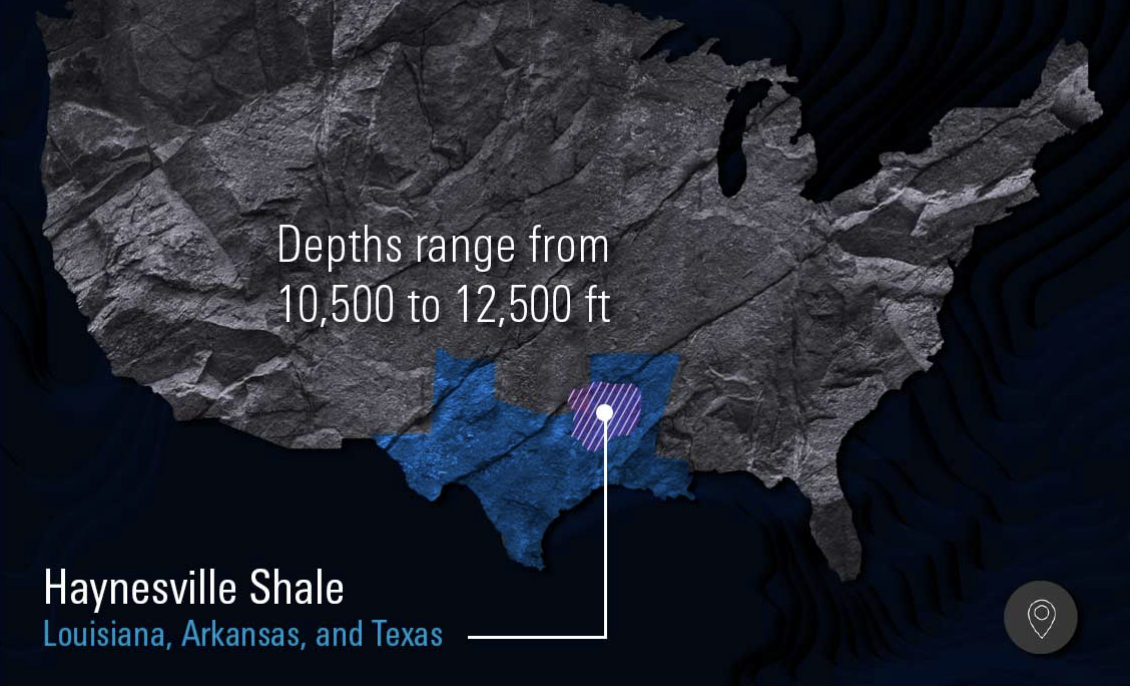

Understanding how much are minerals rights worth in Louisiana takes time, expert knowledge of Haynesville drilling and Operator activity, and personal relationships with the mineral buyers in this area.

Read our article to determine the #1 way to find out how much your minerals are worth.

MINERALS RIGHTS BUYERS

Who Buys Mineral Rights in Louisiana?

Mineral buying companies in Shreveport, Tyler, and Lafayette take into account their own buying parameters, including area of interest (AOI), Operator activity, pay zone potential, and the price of oil and gas, to name a small few of the many factors that go into a buyers’ offer price for your minerals.

Our Selling Process

Client Consultation

We will discuss your needs, wants, and expectations based on the information provided to us about your asset and situation.

Analyze Your Interests

After your consultation and receipt of requested documents, Venergy will take a deeper dive into the facts. We will examine past and current Operator well activity, perform a thorough review of revenue statements, investigate any title issues, and review county data, etc. so we know as many details as possible about your asset(s).

Create a Strategy

With a complete understanding of your interest(s), Venergy will create a customized proposal for market exposure. Knowing how to present your asset is one of the most important aspects of a marketing strategy. With a first-class presentation and expert industry knowledge of your interest(s), Venergy is prepared to represent and negotiate with buyers on your behalf to get you the results you deserve.

Initiate Market Exposure

Our reputable buyer network knows they can expect the best from Venergy. We leave no stone unturned when it comes to marketing your asset while keeping you informed all the way to make the process as transparent and painless as possible.

Lead Negotiations &

Close the Deal

We have experienced nearly every scenario so you can leave the problem-solving and strategy negotiations to us. You will never have to deal with low ball offers, back and forth emails and phone calls with pesky middlemen. When you have proper representation from an industry professional, the chances of you getting taken advantage of and receiving sub-par offers is significantly reduced. Rest assured your deal will be closed with confidence and satisfaction.

Contact Venergy, We Can Help

The golden key is to have a trusted professional that is an expert in the area your minerals are located, knows the companies that buy mineral rights in Louisiana, and has proven experience in getting top offers for their clients.

If you own minerals in the Haynesville Shale and want to know more about how to sell minerals in Louisiana, we can help.

Kyle D. Venema is a Petroleum Landman and Managing Partner of Venergy Momentum Oil & Gas, an Austin, TX-based mineral and royalty consulting and education firm. Learn more about our services, read our 5-star Google reviews and client testimonials, and see our A+ Better Business Bureau page for more information.